History of Farmland Preservation in Polk

The Polk County Farmland Preservation Program Ordinance was adopted in 2002 by the Board of Commissioners after a grassroots committee explored the matter in 2000. The Enhanced program was adopted in 2006. One of the purposes of the Polk County Office of Agricultural Economic Development is to preserve farmland.

Both the VAD and EVAD programs preserve farmland for future generations, but the EVAD program also allows members to take advantage of cost share programs. Both programs may provide extra protection from nuisance lawsuits on properly managed farms.

The program engenders pride in our local agricultural community, and signage “officially” labels your preserved farm.

Read the VAD Ordinance and EVAD Ordinance for more information.

Program Basics

- 2 programs

- Voluntary Agriculture District (VAD)

- Enhanced Voluntary Agriculture District (EVAD)

- Free to join

- 10 year program

- Must be in or qualify to be in present use value taxation

What is Present Use Value?

Present use value is a tax classification for land in agricultural, horticultural, or forestry production. “The value of farmland is taxed for its value as a farm rather than its potential value as residential or commercial property. (N.C.G.S. § 105-277.4.) The practical effect of this is that the property is valued at a lower rate, and therefore the owner’s land is taxed at a lower rate.” See: North Carolina Present Use Value

Qualifications for Present Use Value are as follows:

- Minimum acreage requirements based on usage:

- Horticultural land (fruits, vegetables, nursery, flowers)-5 acres

- Agricultural land (crops, animals)-10 acres

- Forest land (commercial growing of trees)-20 acres

- Forest land requires management plan

- Average gross income from the land of $1,000 for past 3 years

- Applications filed in January

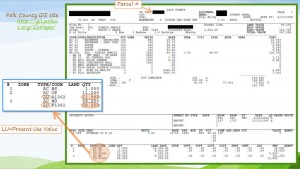

To determine if your property is in Present Use Value, see the Property Record found through the Polk County, NC GIS website. Find your parcel, then scroll down to see the link for “Property Record Card.”

VAD vs. EVAD

- Both VAD and EVAD:

- Must be in present use value taxation

- Conservation plan or forestry management plan

- Can subdivide up to 3 times

- 10 year programs for farm use ONLY

- Must be approved by Farmland Preservation Board

- Boosts the Right to Farm Law

- Free to join and no recording fees

- VAD Only

- 10 year revocable agreement

- EVAD Only

- 10 year irrevocable agreement

- May receive up to 90% for cost share programs

- Preferential opportunities for state and federal programs

Application and more information

To apply for Farmland Preservation, or for more information, call the Office of Agricultural Economic Development at 828-894-2281

- Fill out an application and review a brochure for more information:

- District Conservationist visits and reviews property and creates conservation plan, if wanted or needed

- Application reviewed and approved by Ag Advisory Board

- EVAD enrollment recorded on property deed

- After 10 year period is up, agreement automatically renews for another 3 years